CoolMove - Investment opportunities in Food Loss & Waste reduction through financing cold storage

CoolMove, presented at the FINAS 2025 side session, by Netherlands Food Partnership, Rabobank and Enviu, addressed the urgent issue of food loss and waste (FLW) through financing cold storage solutions in East Africa.

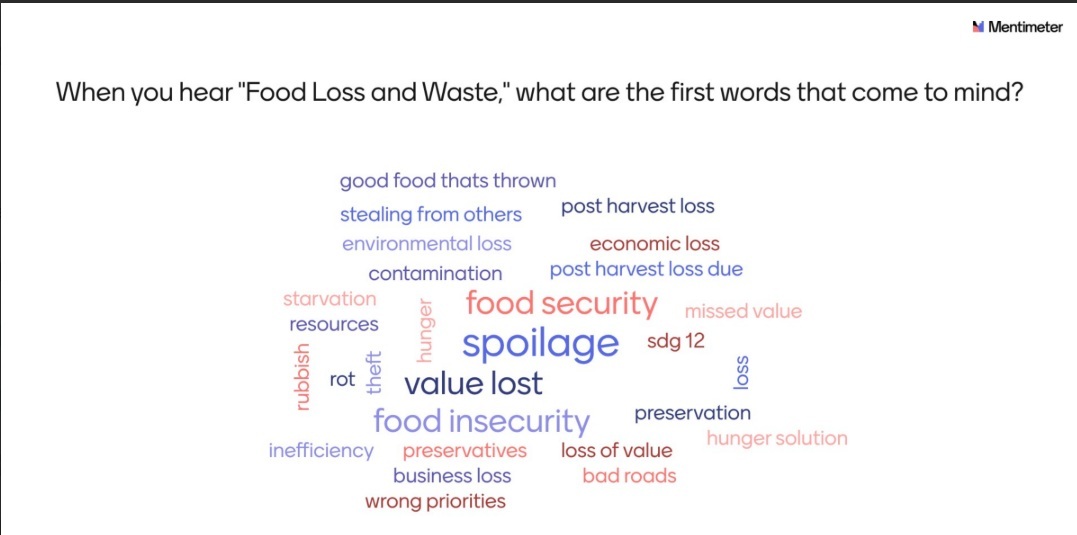

A Mentimeter warm-up exercise revealed that most of the 40 participants in the side session are representatives of private financial service suppliers, followed by non-financial private sector actors. When asked about their first thoughts on Food Loss and Waste, 'food security', 'spoilage' and 'value lost' were prominent initial responses. The majority of participants believe the most critical part of the food value chain for investment is 'cold storage and processing', with as strong runner up 'aggregation & transport' when it comes to FLW reduction. 40% of the participants feel that financial institutions, when it comes to FLW reduction, should focus on 'Providing capital to clients with FLW reduction targets'. Followed by 30% voting for 'engaging companies across the supply chain to encourage waste reduction'. While 17% indicated that Financial Institutions should take on the two mentioned roles completed with 'Developing due diligence processes to assess FLW data', and 'redirecting funding away from companies neglecting FLW issues'. Finally, when asked how they would invest $10 million, the overwhelming majority would invest in cold storage facilities suitable for all relevant levels of the value chain; aggregator, processor as well as small holder famer, cooperative level. Another interesting suggestion was the establishment of an FLW fund to catalyze cold storage investment.

Subsequently Dr. Eveline Jansen of Enviu, partner in Coolmove, took a deep dive into the urgency of food loss and waste reduction as well as the business opportunities it presents. Globally, 30% of food is lost or wasted, resulting in a $1 trillion economic loss and contributing significantly to greenhouse gas emissions. In East Africa, this figure is 40-50% across the supply chain.

Enviu’s Dr. Eveline Jansen highlighted the triple win opportunity of reducing FLW: climate, food security, and sustainability. By investing in cold chain infrastructure, spoilage is reduced, food quality is preserved, market access expands, and farmer incomes improve. FLW is caused by inefficiencies like inadequate storage and poor logistics, making investments in these areas highly impactful.

Business opportunities in FLW prevention include increased agricultural returns, cold chain investments, food processing, digital innovations, and waste recycling. Every dollar invested in FLW reduction can yield a $14 financial benefit. Cold chain development is crucial for preserving perishables, ensuring food safety, and unlocking investment.

Challenges include high capital investment needs and financing barriers for SMEs. However, initiatives like the CoolMove Bid Book, featuring 23 promising East African businesses with Dutch links, are driving momentum. The goal is to direct more financing to FLW reduction and create environmental, social, and economic impact.

Mr. Godfrey Mambo of Rabobank, partner in Cool Move, shared a banking perspective on FLW strategies. He emphasized that the lack of cold chains is a key determinant of food losses of perishable foods, but can also create a triple win: it lowers the environmental footprint, it has social impact as it improves food availability and nutrition and it saves money and increase incomes of small holder farmers. Rabobank and other partners in cool move promote the development of sustainable cold chain in rural areas, based on bankable and scalable business models via financial solutions, backed by market linkages and data. The Cool Move Coalition is led by a consortium of leading institutions: WRI - Champions 12.3, Rabobank, Enviu, World Bank, Wageningen University, Global Food Cold Chain Council, UNEP and WWF. Local entrepreneurs and business involved are a/o Secure Fisheries, SokoFresh, Flying Swans, Farm to Feed and DCA.

A panel of public, private and impact investing experts discussed the challenges and opportunities of investing in Food Loss and Waste Reduction, moderated by Mr. Godfrey Mambo of Rabobank. The panel of experts consisted of:

- Mr. John Ndungu, Kenya Development Cooperation (KDC)

- Mr. Bernard Ogala, horticulture specialist, Equity Bank Kenya Ltd

- Ms. Ulla Balle, Senior Advisor on Blended Finance, Dan Church Aid (DCA)

- Mr. Peter Owaga, Managing Director, Truvalu Kenya

Below some highlights mentioned as biggest misconception and challenges when it comes to financing food loss and waste reduction, as well as the key take aways from the panel discussion.

Misconception and Challenges :

* The perception of high risk in financing these solutions. She stresses the need for quantifiable data to demonstrate viable business cases. Her project's early data (6 months) shows a 20% drop in FLW, Ksh 14M value produced, and Ksh 3.7M value lost (approx. $30k, the cost of one cold unit), indicating potential. Advocates for blended finance and collaboration to make solutions affordable.

* That FLW solutions are primarily for philanthropic capital. He highlights the commercial viability, referencing the often-cited statistic that $1 invested in cold chain can yield $14 in economic benefit.

Key Takeaways

Commercial Viability is Key: A major recurring theme is the need to shift the perception of FLW and cold storage solutions from being purely philanthropic endeavors to commercially viable investment opportunities. The "$1 invested yields $14" figure was mentioned multiple times.

Data-Driven Decisions: All panelists emphasized the critical need for robust data to demonstrate business cases, de-risk investments, and attract capital.

Ecosystem Approach & Collaboration: Reducing FLW requires a collaborative effort involving farmers, SMEs, financial institutions (DFIs, commercial banks, impact investors), government, and NGOs. Blended finance models are seen as crucial.

Fragmentation: The agricultural sector's fragmentation is a significant hurdle, making it difficult to implement widespread solutions. Aggregation models and platform approaches are needed.

Impact Beyond Profit: While commercial viability is essential, the profound social and environmental impact of reducing FLW (empowering farmers, improving food security, resource efficiency) is a strong motivator.

Early Successes: Dan Church Aid's L2V project shows promising early results in reducing losses and creating value with relatively simple interventions.

Join the Kenya CoP Food System Finance and exploring the Bid Book for collaboration and investment opportunities in Reduction of Food Loss & Waste through Cold Storage in East Africa !

Authors

Lisette van Benthum

NFP Coalition Builder

Ibrahim Palaz

Coalition Builder